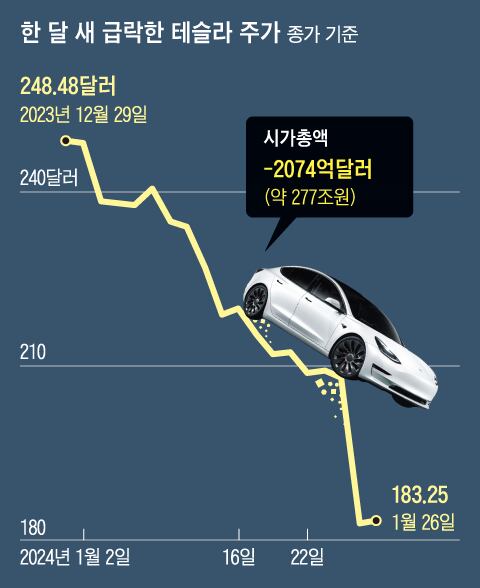

Tesla Going Backwards: Market Capitalization Evaporates 277 Trillion Won In One Month

Tesla going backwards The market capitalization of Tesla, the icon of the electric vehicle industry, which reached $789.9 billion (approximately KRW 1,055 trillion) at the end of last year, decreased by $207.4 billion (approximately KRW 277 trillion) in less than a month until the 26th of this year.

The size equivalent to the market capitalization of the four companies ranked 2nd to 5th in terms of market capitalization in the Korean stock market, SK Hynix, LG Energy Solutions, Samsung BioLogics, and Hyundai Motor Company, has evaporated. Tesla’s stock price fell 36% during this period from $248.48 per share on December 29th of last year. This is contrary to the NASDAQ index, where Tesla is listed, which rose by about 3%.

Tesla is a company that has led the current global electric vehicle industry. In 2021 alone, the stock price exceeded $1,000 per share, sparking a ‘1,000 Sla’ craze at home and abroad. As of the 25th, ‘Seohak Ant’, which invests overseas in Korea, holds about $10 billion (about 13 trillion won) worth of Tesla stocks. Investments were focused on the perception that the company was the first to introduce the concept of controlling and remotely updating cars with software and spread various innovations such as ‘giga casting’, which prints the entire car body at once.

However, among automobile industry and stock market experts, there is a series of worrying predictions that “Tesla will face a difficult time in the next one to two years.” JP Morgan of the U.S. also predicted that Tesla’s stock price would fall 30% further by the end of this year. What happened to Tesla?

Tesla Going Backwards, An Automobile Company Without New Cars.

sells only pure electric vehicles that run only on electric motors. However, last year, the growth rate of global electric vehicle sales began to take a hit when it slowed down from 67% in 2022 to 39% last year (as of the first to third quarters). This was in contrast to last year’s record-breaking performance by other car companies such as Toyota, Hyundai Motor Company, and Kia, which increased sales of hybrid vehicles instead of electric vehicles.

Tesla decided to maintain its market share even amidst the ‘electric vehicle crisis’ and came up with a ‘price reduction’ policy. The price of the car was drastically discounted throughout last year. The result is the fourth quarter performance of last year announced by Tesla on the 24th. As sales increased due to price discounts, sales increased by 8% compared to the fourth quarter of 2022 to approximately $25.2 billion, but operating profit during the same period was cut in half to $2.1 billion.

The New York Times reported, “Tesla used to be the most profitable automobile company in the world, but is now at a similar level to other companies,” and added, “If it were not for various electric vehicle subsidies, net profit in the fourth quarter of last year would have been negative compared to the same period last year.”

Typically, automobile companies overcome poor performance by launching attractive new cars. However, Tesla has no new cars to release for over a year. Tesla’s best-selling electric SUV, Model Y, has been out for four years and has lost its novelty. The goal is to produce 130,000 units of the electric pickup truck ‘Cybertruck’ a year, a new vehicle launched at the end of last year, but production is not smooth, so it does not contribute to profits. A new mid-price car under development called ‘Model 2′ will not be released until the second half of 2025. We have to endure with Model 3·X·Y·S.

Tesla was unusually unable to set an annual sales target this year. Many analyzes say that although the company has technological prowess, it is because it is in an uncertain situation where there are no new products to immediately open consumers’ wallets.

Can The U.S. Election And China Overcome Variables And Technological Capabilities?

This year’s U.S. presidential election is also a variable. Tesla has an annual production capacity of up to 2.35 million units at its plants in the United States, China, and Germany, of which China accounts for 40% (approximately 950,000 units). Last year alone, about 340,000 Teslas made in China were exported and sold to Asia, including Europe and Korea. There is continued speculation that if former President Donald Trump, who has strong anti-China sentiments, is elected, a shock to sales of Chinese-made Teslas is inevitable.

However, the IT technology that is ahead of other companies is a differentiating factor. A representative example is FSD ( Full Self Driving ), an autonomous driving technology based on AI (artificial intelligence) and supercomputers that are being developed in-house . Tesla plans to release the upgraded FSD to the public as early as next month. In particular, as they are seeking to increase profits by selling this technology to other automobile companies, attention is being paid to whether they can make up for the slump in electric vehicles. Another variable is whether it will be possible to commercialize the human-shaped robot ‘Optimus’, which is expected to be produced next year.

See More:

Putin Runs For 5th Term As An Independent

American Cloud Service Companies All Under Chinese Export Controls

Korea And NASA Discuss Lunar Exploration Cooperation

Technology To Recognize Human Emotions In Real Time Has Emerged

Leave a Comment